21+ ramsey mortgage rule

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Transfer A Mortgage To Another.

Is Dave Ramsey Right About How Much House You Can Afford

181 15 second mortgage 16 home equity loan 7 both second mortgage and home equity loan Houses without a.

. Compare offers from our partners side by side and find the perfect lender for you. That 25 limit includes principal interest property taxes home insurance. Web Web NMLS 2280 Phone800-955-0021 2023 21st Mortgage Corporation.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Sponsored Mortgage Options for Fawn Creek Township. Ad Calculate Your Payment with 0 Down.

Lock Your Rate Today. Web Web The process of buying and selling property can be confusing and transferring property comes with its own set of rules and requirements. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

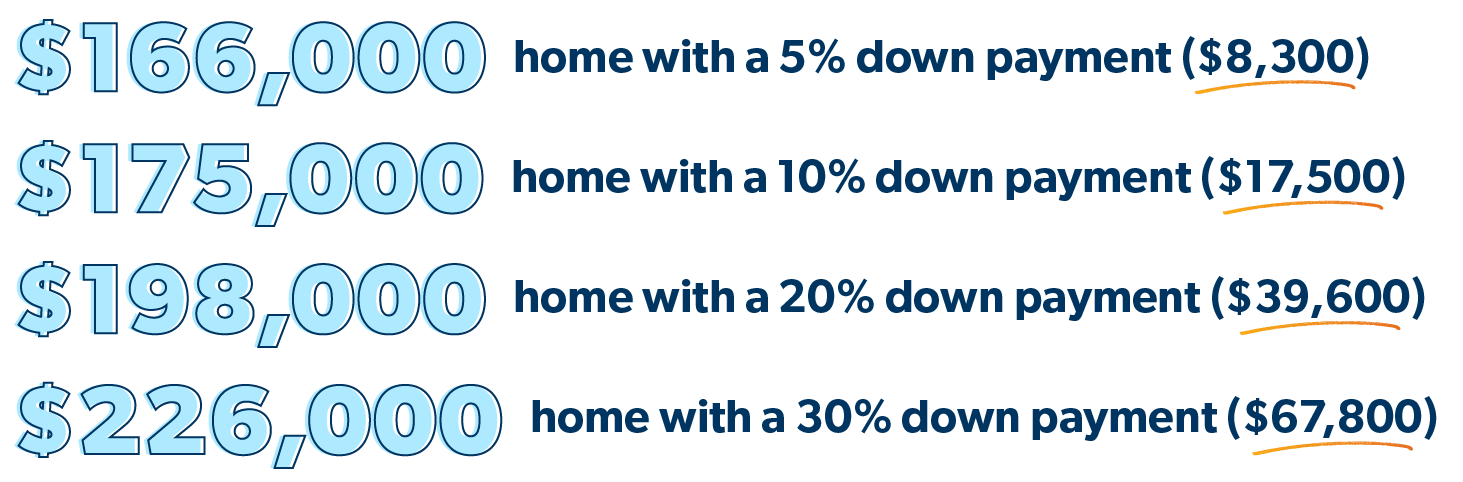

Web Ramsey recommends that you take out a mortgage with a monthly payment of no more than 25 of your take-home pay. Web Housing units in Fawn Creek township with a mortgage. Web The 2836 rule means that your mortgage should be no more than 28 of your total income on housing related costs and 36 on all debts mortgage credit cards.

Other financial experts say your total predictable. Save Real Money Today. Ad Compare the Best Home Loans for March 2023.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments. Web When there is a Social Security.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Following Dave Ramseys 25 percent rule your monthly mortgage should not exceed 1125 on a 15-year loan. 9600 in health insurance 800mo Take home.

Web As a general rule your housing costs including your mortgage payment property taxes and homeowners insurance should not equal more than 30 of your take. Compare todays top mortgage and refinancing providers. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments.

73000 6830 mo 15000 to retirement 15 of gross Take home -. He wants you to pay off all of your other debt first and then start setting aside 15 of your. Apply Get Pre-Approved Today.

According to Ramsey your monthly housing expenses should never be higher than 25 of your. Get Instantly Matched With Your Ideal Mortgage Lender. Web Ramsey has the simplest affordability calculator youll find.

By using a 3 percent interest rate 20 percent down payment. Web Ramsey and his writers at Ramsey Solutions have repeatedly scared older homeowners with the claim You ll Likely Owe More Than Your Home Is Worth 1. Web To be fair Ramsey does not advise paying off your mortgage as a first step.

Find a loan thats right for you.

Best Real Estate Investing Advice Ever Podcast Addict

Dave Ramsey S 5 Steps For Figuring Out How Much Home You Should Buy

Mountain Democrat Wednesday December 7 2022 By Mcnaughtonmedia Issuu

Custodial Account For Your Child A Good Idea Arrest Your Debt

Mountain Xpress 07 21 21 By Mountain Xpress Issuu

How Much House Can I Afford Ramsey

Why I Stopped Following Dave Ramsey Ninjabudgeter

Housing Shelter Bergen Resourcenet

The 50 30 20 Rule Ramsey

Mortgage Loan Do S And Don Ts Ramsey

Calameo 20150212

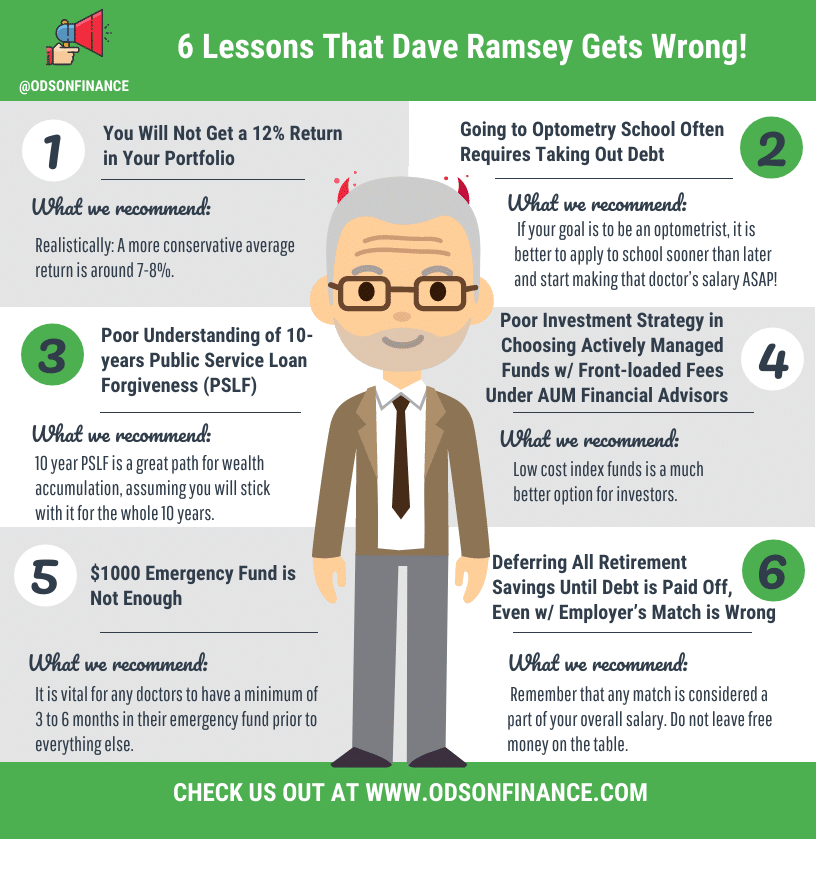

6 Lessons That Dave Ramsey Get Right And 6 Lessons That Are Completely Wrong Ods On Finance

Is It Better To Invest In Bonds Or Pay Off My Mortgage Quora

Ayvtdk Rqpjopm

How Much Of A Mortgage Payment Can We Afford Youtube

Mortgage Loan Do S And Don Ts Ramsey

Calameo February 10 2023

Komentar

Posting Komentar